Key Points:

- EchoStar, the owner of Dish Network and Boost Mobile, is giving up the dream of building a new fourth nationwide cellular carrier and is selling off its core spectrum assets to AT&T and SpaceX.

- SpaceX buying cellular spectrum rights is a major strategic shift - potentially opening up the possibility that SpaceX might someday directly offer Starlink Cellular service. No current cellular hardware is compatible with this new spectrum - but SpaceX is putting enormous pressure on carriers and hardware makers to get on board.

- Leaked documents reveal that T-Mobile has plans to phase out its 4G/LTE network more rapidly than anticipated - devoting more capacity to its 5G SA (standalone) network. This will negatively impact all 4G and early generation 5G hardware on T-Mobile's network.

- Years behind T-Mobile, AT&T and Verizon are at last deploying 5G SA capabilities of their own, seemingly spurred in part to support Apple Watch 5G.

In the past few weeks, several major stories have emerged that are seismically shaking up the cellular industry, with impacts likely to be felt for years to come.

To start with, EchoStar (owner of Dish Project Genesis and Boost Mobile) looks to be giving up on the dream of building the fourth nationwide cellular network, throwing in the towel to the big three - T-Mobile, AT&T, and Verizon.

But rather than simplifying the competitive landscape, this development could make things a lot more complicated.

Most interestingly, EchoStar is selling core cellular spectrum to SpaceX, which could serve as the foundation for the next generation of Starlink direct-to-cellular capabilities, well beyond what is possible today.

This could theoretically open the door for SpaceX to directly offer Starlink Cellular service globally in the years ahead, without relying on partners.

In the present day, T-Mobile has moved ahead with enabling limited data services with its T-Satellite service, created in partnership with Starlink.

And leaked documents reveal that T-Mobile seems to be ramping up plans to phase out its 4G network capacity much more rapidly than most expected.

Meanwhile, AT&T and Verizon are finally moving to catch up with T-Mobile, with some significant new 5G capabilities of their own coming online.

In other words, a lot is up in the 5G world!

Read on for details...

This analysis builds upon our featured article from March:

For more on the basics of what makes 5G compelling, see our guide:

Table of Contents

Part 1: EchoStar Giving Up On Project Genesis, Yet Boost Will Live On

All throughout the 2G, 3G, and most of the 4G eras, the cellular market had two big dominant nationwide networks - AT&T and Verizon.

And two scrappy nationwide underdogs - T-Mobile and Sprint.

When T-Mobile acquired Sprint in 2020, regulators wanted to keep this four-way competition alive, so the FCC made approving the deal contingent on T-Mobile setting up Dish Wireless - a new EchoStar subsidiary - with enough spectrum (and roaming rights) to allow it to viably build a nationwide cellular network from the ground up - what became known as Project Genesis.

Against all odds - Dish Wireless actually succeeded in building a very impressive 5G network.

But building a new nationwide cellular network from scratch is a monumental undertaking - and Dish was slow to fill in coverage gaps, making it not particularly useful as a primary provider for most nomads. And as the network grew, Dish stopped offering a hotspot plan and instead focused on smartphones, primarily sold under the budget Boost Mobile brand, which had also been acquired from T-Mobile.

Those of us lucky enough to grab Dish's amazing $20/mo unlimited mobile hotspot plan before it was discontinued in 2023 have had full access to Dish's network. In many areas, Dish actually outperformed other carriers.

No surprise - Dish's network was an empty half-built highway with no on-ramps and few cars, as compared to the congestion on the other big carriers.

Dish Wireless had built a network - but it had absolutely failed in acquiring enough customers to make all this effort worthwhile.

It has been clear for a while now that Dish Wireless had no chance of succeeding on its own as a viable business, particularly due to its confusing branding and other missteps that prevented it from building a customer base.

EchoStar Selling Cellular Spectrum To AT&T

In late August, Dish Wireless's parent company, EchoStar, announced a $23 billion deal to sell a large part of its core high-performance mid-band and long-range low-band 5G spectrum assets to AT&T.

AT&T shared that it will be able to move rapidly to use EchoStar's mid-band spectrum to increase its C-Band capacity, since AT&T towers already have compatible radios.

Taking advantage of the low-band n71 (600 MHz) spectrum, on the other hand, will likely take AT&T a significant amount of time since tower upgrades will be required.

AT&T has not provided a timeline for when it expects to push this n71 deployment. However, once this long-range spectrum is live, it will work well for filling in coverage map gaps in rural areas.

Overall, this is a big win for AT&T.

Verizon is also reported to be in talks with EchoStar, picking through the bones to grab some remaining spectrum of its own.

With all these spectrum sales, Dish Wireless will no longer have a cellular network to operate.

Boost Mobile Lives On As a Hybrid MNO

With so much core spectrum being sold, it is clear that EchoStar is getting out of the business of physically operating a cellular network.

With so much core spectrum being sold, it is clear that EchoStar is getting out of the business of physically operating a cellular network.

But EchoStar is not getting out of the cellular business entirely - the deal with AT&T guarantees that Boost Mobile will live on as a "Hybrid MNO (Mobile Network Operator)" with a Dish-operated 5G network core that relies on physical towers operated by partners:

"Through Boost Mobile's hybrid MNO infrastructure, subscribers will continue to receive service from Boost Mobile's cloud-native 5G core connected to AT&T's leading nationwide network. While primary connectivity will be provided by AT&T's towers, Boost Mobile subscribers will continue to have access to the T-Mobile network. Customers will experience no interruptions to service. As a result of this transaction, elements of Boost Mobile's radio access network (RAN) will be decommissioned over time."

Now that the deal is announced, Dish is expected to begin decommissioning its physical network any day now.

We have seen reports that Dish's native cellular service has already been shut down in some markets, with towers being switched off entirely. But we can also report that Dish service still lives on where we are currently traveling (Baltimore, MD) - with great native speed and reliability.

From a consumer standpoint, it is unfortunate to see a market with four nationwide carriers shrink to three. Less competition is rarely an improvement.

But from the perspective of current Boost and Dish customers, these changes might ultimately prove to be beneficial.

In particular, if legacy Boost and Dish Genesis plans remain grandfathered in (no guarantees!), coverage and performance might end up improving for current customers.

But no matter how things shake out, Dish Wireless will never again offer a truly independent cellular network.

The dream of four fully independent nationwide cellular carriers seems to be dead and buried.

But there might soon be a new truly global cellular player...

Part 2: SpaceX Buys Up Cellular Spectrum, Previews Next-Generation Starlink Direct To Cell Constellation

Shortly after announcing the deal with AT&T, EchoStar announced that it was selling another large chunk of spectrum to SpaceX for $17 billion.

Up until now, SpaceX relied on terrestrial partners to essentially borrow spectrum rights for limited direct-to-cellular service.

But now, once this deal closes, SpaceX will have some cellular-appropriate spectrum that it actually wholly owns global rights to.

SpaceX President & COO Gwynne Shotwell hinted at the potential:

"SpaceX's first generation Starlink satellites with Direct to Cell capabilities have already connected millions of people when they needed it most – during natural disasters so they could contact emergency responders and loved ones – or when they would have previously been off the grid. In this next chapter, with exclusive spectrum, SpaceX will develop next generation Starlink Direct to Cell satellites, which will have a step change in performance and enable us to enhance coverage for customers wherever they are in the world."

The first generation of Starlink Direct to Cell is designed to only broadcast where there is no terrestrial cell signal. Because of the shared spectrum, the signals from cell towers and from space can not co-exist in the same location. This means that SpaceX can only offer to help fill in coverage gaps, not provide any sort of true native coverage from orbit.

But the new spectrum from EchoStar is set aside for exclusive satellite use - enabling a truly global satellite-to-device network.

But there is a catch - this new generation of Starlink direct-to-cell capabilities will require not just entirely new Starlink satellites, but entirely new cellular devices too.

Starlink Next Generation Direct To Cell

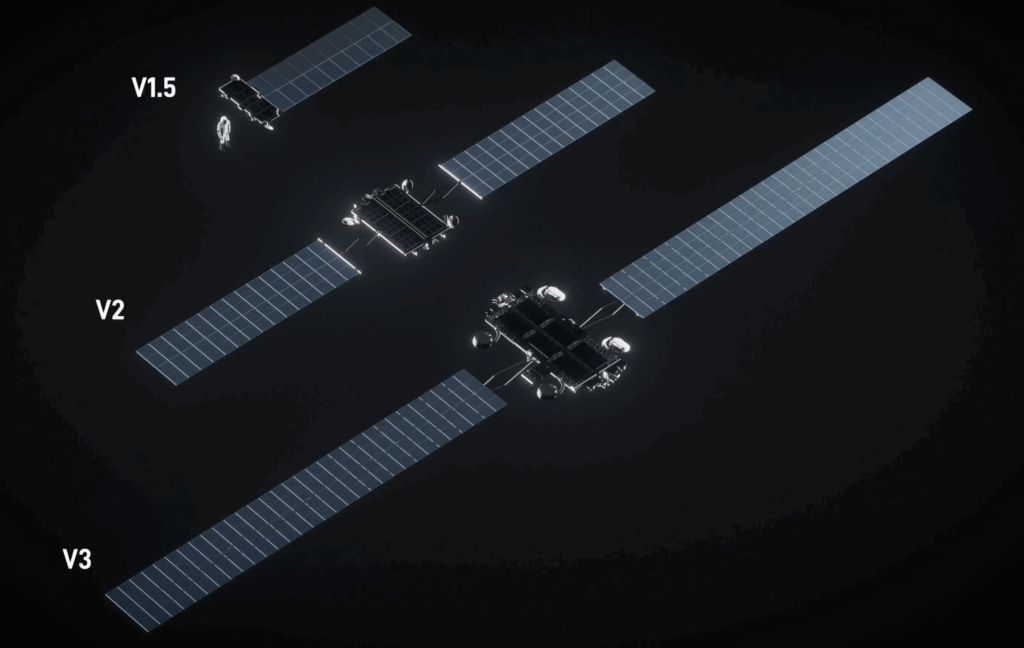

As we have covered here extensively, SpaceX has been piggybacking cellular payloads on a subset of Starlink satellites for a while now to enable "Direct To Cell" capabilities that allow communications between Starlink satellites and regular unmodified cellular phones.

Up until now, these capabilities have only existed in partnership with terrestrial carriers - SpaceX has to work with legacy partners because it has no cellular spectrum rights of its own. In the USA, SpaceX has partnered with T-Mobile for the T-Satellite service that launched in July.

But SpaceX's complete reliance on partners is changing - by acquiring spectrum from EchoStar, SpaceX is essentially turning itself into a new nationwide (and potentially global) cellular provider.

But don't get too excited just yet. Unlike the first-generation service, the new spectrum SpaceX is buying is NOT compatible with current cellular devices or the current satellites in Starlink's Direct to Cellular constellation.

SpaceX's update post on the deal with EchoStar reveals a few additional details:

"Through the agreement with EchoStar, SpaceX will purchase EchoStar’s 50 MHz S-band spectrum in the US (bands known as AWS-4 and PCS-H) as well as its global MSS spectrum licenses. Exclusive access to this spectrum, along with use of optimized 5G protocols designed for satellite connectivity, will enable a step change in performance for Starlink Direct to Cell."

This spectrum is particularly well-suited for satellite direct-to-device usage, but it has remained unused for that purpose.

EchoStar acquired this spectrum long ago, but it was never able to convince device makers to invest in compatibility, as few expected EchoStar would ever deploy a viable service in orbit. EchoStar could not secure investors to build the satellites for this service because no device makers were on board.

It was a classic chicken-and-egg / satellite-and-handset problem...

But SpaceX has already demonstrated it can build a satellite constellation, and it has a credible story when talking about what a next-generation Direct to Cell constellation will be capable of:

"The next generation of Starlink Direct to Cell satellites will be designed to fully utilize this spectrum. Driven by custom SpaceX-designed silicon and phased array antennas, the satellites will support thousands of spatial beams and higher bandwidth capability, enabling around 20x the throughput capability as compared to a first-generation satellite. With the world’s most advanced phased arrays, the wider bandwidth operations enabled by this spectrum purchase, and optimized 5G protocols, the system will support an overall capacity increase of more than 100x the first generation Starlink Direct to Cell system. In most environments, this will enable full 5G cellular connectivity with a comparable experience to current terrestrial LTE service, which will be used in partnership with Mobile Network Operators to augment high capacity terrestrial 5G networks."

In FCC filings requesting authorization to use the EchoStar spectrum, SpaceX says that it intends to build a 15,000-satellite next-generation Starlink constellation, which will dwarf the current Starlink constellation in capacity.

The filing even hints at future terrestrial ambitions - with SpaceX perhaps someday building cell towers of its own to add capacity to the satellites:

"SpaceX may deploy ground-based systems in the U.S., creating a hybrid satellite/terrestrial network to expand the coverage and capacity of these services."

In other words, SpaceX has significant ambitions for this spectrum.

This new next-generation Direct to Cell capability will piggyback to orbit on future Starlink V3 satellites, which require SpaceX's Starship to be operational for a ride to orbit.

For the latest on Starship, see our recent story on the tenth Starship test launch:

The eleventh test launch on October 13th, 2025, was also a complete success - paving the way for Starship to ramp up towards further test flights and actual Starlink V3 deployment missions sometime in the first half of 2026.

It will likely not be until 2027 or even 2028 that enough of these next-generation satellites are in orbit to offer full next-generation service, hopefully giving cellular hardware manufacturers enough time to build in compatibility.

Cellular Device Compatibility Concerns

The big catch with EchoStar's S-Band spectrum is that it is NOT compatible with current 5G cellular devices.

SpaceX needs to encourage phone and device manufacturers to add support for their products to make this considerable investment worthwhile.

Satellite industry veteran analyst Tim Farrar has shared some thoughts around how SpaceX is moving to try to dominate the market and squeeze out all potential satellite competition:

"But ROI has never been the primary determinant of SpaceX’s decisions, when the opportunity presents itself to dominate an industry and force competitors out. That’s why we are seeing aggressive actions from Starlink in the satellite broadband market, lowering prices for hardware and service in both the consumer and professional markets to make Amazon Kuiper’s entry harder.

And in this case, by spending $17B, SpaceX has not only persuaded EchoStar to give up its D2D plans but has now made it much harder for any competitor to move forward when they can’t possibly compete with SpaceX’s speed in bringing new satellites to market."

SpaceX in particular wants Apple on board, and for Apple to give up on funding the next generation Globalstar C3 satellite constellation that powers Apple's native satellite capabilities:

"SpaceX especially wants Apple to cooperate instead of pursuing the C-3 constellation because the H-block and AWS-4 spectrum, that SpaceX is now acquiring from EchoStar, is not supported by any current phones (EchoStar’s Band 66 and Band 70 used different frequency pairings). Thus support from device manufacturers will be needed to get the new capabilities enabled by this spectrum into consumers’ hands in the near term. Of course if Apple doesn’t come around, then there’s always the possibility that SpaceX will announce a “Starlink phone”..."

The concept of a Starlink or Tesla phone has been hyped (and debunked!) for years - but it would be an enormous undertaking.

Elon Musk has made it clear that he sees building a phone as a last resort:

“Man, I sure hope we don't have to make a phone. That's a lot of work. The idea of making a phone makes me want to die. But if we have to make a phone, we will, but we will aspire not to make a phone."

There are interesting games of corporate chicken underway - with billions on the line.

At a recent online summit, Elon Musk said he expected it would take two years for hardware compatible with the EchoStar spectrum to reach the market, so it will be a while before we see the eventual outcome of the backroom deals currently being discussed.

Is SpaceX Competing With The Carriers Now?

Yes. No. Maybe.

SpaceX has a complicated relationship with the cellular carriers, and it will become even more complex now that SpaceX has some spectrum of its own to factor into negotiations.

To launch its Starlink Direct-to-Cell network, SpaceX partnered exclusively with T-Mobile in the USA to build T-Mobile's T-Satellite offering. It's also partnering with other carriers in other countries to provide the same service.

T-Mobile would like to retain this unique competitive advantage, but SpaceX has made it clear that this exclusive partnership was time-limited and that it is open to working with other carriers as well.

Meanwhile, AT&T and Verizon have been investing in AST SpaceMobile's upcoming satellite direct-to-cell constellation, which is technically compelling - but deployment has slipped.

Some analysts expect that SpaceX will use the threat of direct competition to try to lure the other carriers away from SpaceMobile, to cut off investment in a future competitor.

There is a lot of speculation that SpaceX's spectrum purchase is partly a threat, signaling to carriers that they must either partner with SpaceX or risk SpaceX competing with them directly.

But perhaps SpaceX really will launch Starlink consumer cellular service after all...

When asked about the EchoStar spectrum purchase at an online summit, Elon Musk actually expressed that he hopes to offer cellular service directly to consumers:

"But yes, you should be able to have a Starlink – like you have an AT&T or a T-Mobile or a Verizon or whatever – you could have an account with Starlink ... It would be a comprehensive solution for high bandwidth at home and for high bandwidth direct to cell.”

With the spectrum SpaceX has purchased, Starlink Direct to Cell has the potential to power the first global cellular network - potentially putting Starlink in competition with every cellular carrier in the world.

But the spectrum SpaceX controls is tiny compared to even the smallest regional carriers.

Starlink might be able to offer global coverage, but it will still depend on terrestrial partners and/or roaming agreements to ever offer acceptable coverage indoors, in urban areas, or anywhere there might be enough people online to cause congestion.

And even at best, the next generation Starlink Direct to Cell constellation is aiming for just 4G level speeds - a "comparable experience to current terrestrial LTE service".

Even Elon acknowledges this reality:

“To be clear, we’re not going to put the other carriers out of business. They’re still going to be around. They own a lot of spectrum...”

In typical Elon fashion, he then joked about buying Verizon to gain control of its spectrum and towers.

T-Satellite Gets Limited Data Support

If you don't want to wait two or three years for next-generation Starlink Direct to Cell service, T-Mobile officially launched the Starlink-powered T-Satellite service in July with basic text messaging.

This month, the service expanded and began allowing some apps to have limited data connectivity as well, including voice and video chats over WhatsApp.

Functionality over satellite connections is still extremely limited, but it is indeed technologically impressive to enable a pocket-sized device to manage a video call from the middle of nowhere.

T-Satellite service is included in T-Mobile's top-tier smartphone plans for both business and consumer customers, or as a $10/month add-on for other T-Mobile plans.

Non-T-Mobile customers can get T-Satellite with a compatible phone that supports eSIM.

Boost Mobile Getting Starlink Support Too

As part of the deal to acquire the EchoStar spectrum, SpaceX has entered into a long-term agreement to allow Boost Mobile customers access to the next-generation Starlink Direct To Cell network.

This doesn't seem likely to apply to the current Starlink Direct to Cell constellation that T-Mobile is using today, but in a few years, when the next-gen constellation is online, this could prove to be a major perk for Boost Mobile customers.

It seems likely that in the near future, every cellular carrier (and MVNO) will feel competitive pressure to enter into a similar partnership to avoid being left behind in satellite coverage.

Dead zones really will soon be a thing of the past, at least outdoors...

Verizon and AT&T Betting On AST SpaceMobile

The most viable potential competitor to Starlink's next-generation Direct to Cell constellation remains AST SpaceMobile.

SpaceMobile has demonstrated broadband capabilities to existing cellular devices, but it doesn't have enough satellites in orbit yet to offer commercial service.

SpaceMobile claims that it has secured enough investment to fully fund the development of its constellation and is on track to deploy between 45 and 60 of its large satellites in 2026, enabling it to finally deliver continuous cellular-based broadband service across the U.S., Europe, Japan, and other strategic markets.

Just last week, Verizon signed a deal with SpaceMobile - pushing ahead despite SpaceX's pressure to pull back.

But can SpaceMobile keep up with Starlink?

Satellite industry analyst Tim Farrar shared some insight with Ars Technica, noting that in 2022, AT&T CEO John Stankey claimed that AT&T and AST SpaceMobile were 18 months ahead of T-Mobile and Starlink:

"You look at where we are three years later, and you're like, well, if you're lucky, AST is 18 months behind Starlink, and it's probably more than that. So they've not kept up. It's all very well for them to claim technological superiority, but they don't have [many] satellites in space, and Starlink has 650 of them in space for this service."

When SpaceX brings Starship online, its advantage is likely to only accelerate.

Will there come a point where Verizon or AT&T chooses to hedge its bets?

Part 3: 5G SA Everywhere: 5G Evolves, 4G Devolves

If all the dramatic changes happening in space weren't enough excitement, there are some significant terrestrial cellular developments too that will have an even more immediate impact on mobile internet users.

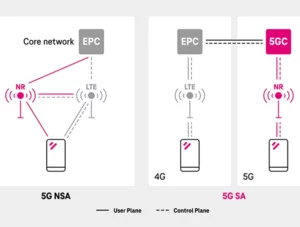

But to understand what is changing, you need to know the difference between 5G SA (standalone) and 5G NSA (non-standalone).

When 5G networks first emerged, to remain compatible and complementary with 4G networks, the carriers launched 5G running in NSA mode, meaning that the 5G network was still dependent on the underlying 4G network core for many functions.

Essentially, the 5G NSA connection uses LTE as an anchor with 5G channels layered on top for more performance. But the network still required 4G to function - it could not stand alone.

This was a great stopgap to make the transition from 4G to 5G easier and seamless to customers. However, it also meant that cellular networks were still impacted by the limitations of the underlying 4G network. In particular, upload performance and latency could suffer on 5G NSA. And even battery life could be affected by devices needing to keep both the 4G and 5G radios alive simultaneously.

5G standalone ditches the dependence on an underlying 4G connection; it is a truly native 5G network.

T-Mobile led the world in turning on 5G SA capabilities - enabling it nationwide way back in 2020.

Dish Network was next with 5G SA, since Dish was starting from scratch without a 4G network to worry about.

AT&T and Verizon, however, have dragged their feet in activating 5G SA - concerned that the benefits might not outweigh the potential compatibility and performance impacts on older devices.

Both carriers have been talking about enabling 5G SA "soon" for years now - always seemingly six months away. But the dike has burst - potentially with a bit of help from Apple.

Apple's latest Apple Watch models include 5G for the first time, using 5G "RedCap" - Reduced Capability - modems.

5G RedCap is perfect for devices like watches because it is small and power-efficient, sacrificing peak performance (which isn't necessary for a watch) for power efficiency. However, the 5G RedCap standard does not include support for 5G NSA mode, and so the modems used in the new Apple Watch models do NOT support 5G NSA. So on 5G, they will only connect where 5G SA is available. If 5G SA isn't available, they will fall back to using LTE.

Apple Watch is the first significant consumer 5G product that doesn't include 5G NSA support, which might have pushed AT&T and Verizon to turn on 5G SA broadly, enabling wider deployment.

AT&T officially announced nationwide 5G SA on Oct 8, 2025; Verizon told the trade press it’s deployed nationwide (with some sites still being enabled).

The 5G SA Downsides

When a network is running in NSA mode, both 4G and 5G spectrum are being utilized.

But in SA mode, the 4G spectrum is no longer needed or used. So to better serve customers connected via 5G SA, carriers have an incentive to shift some of their spectrum from broadcasting 4G to broadcasting 5G. And, eventually, the carriers will move entirely to 5G and sunset the 4G network, like the 2G and 3G networks before.

Additionally, all the carriers have newer spectrum that is exclusively for 5G.

This is great for people with the latest cellular devices, as it enables faster speeds and more capacity overall.

But for people with 4G/LTE devices, the increased use of 5G exclusive spectrum and the switch to 5G SA mean less network coverage and capacity for LTE.

Additionally, earlier generations of 5G devices can be negatively impacted because they often do not support the newest 5G spectrum and capabilities, particularly when carrier aggregation is used to combine multiple 5G SA bands.

These older devices were designed when 5G was new, and so they operate best with a robust LTE network and 5G NSA mode.

Not wanting to upset too many legacy customers is why AT&T and Verizon have been so slow to switch to 5G-SA.

T-Mobile, on the other hand, has sufficient excess spectrum and experience with 5G SA, and they now seem ready to go all-in towards an SA-only future.

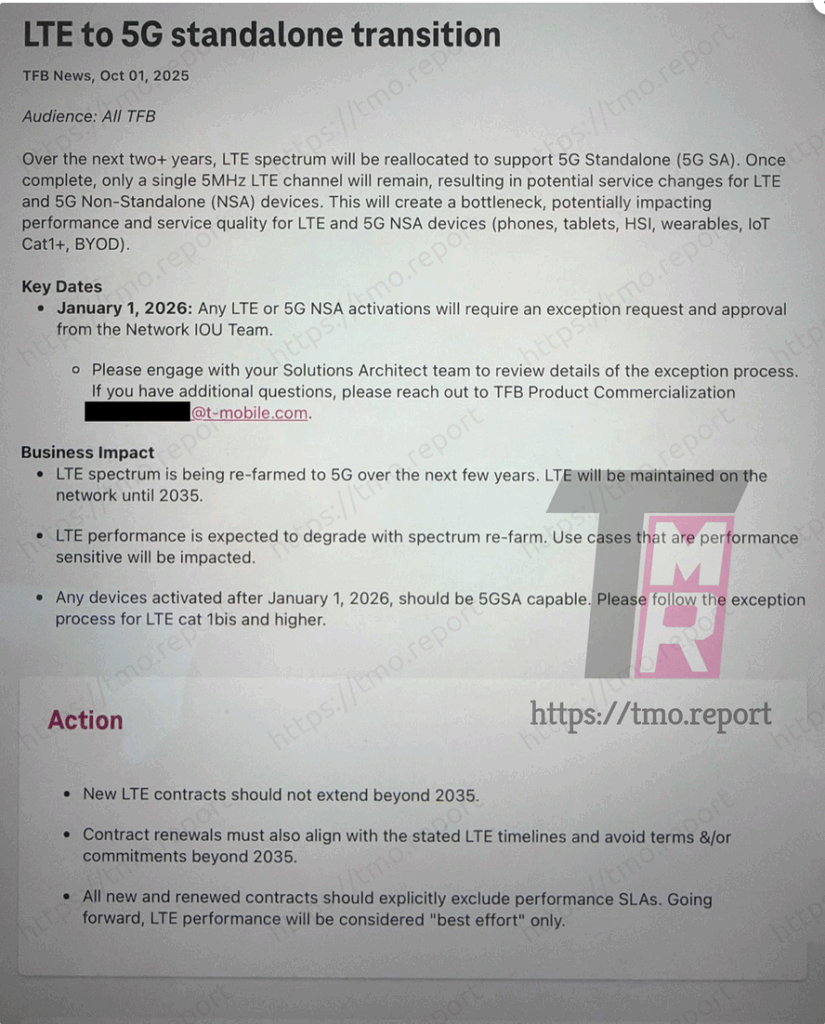

Recently leaked documents reveal that T-Mobile is accelerating plans to phase out its 4G/LTE network more rapidly than anticipated, aiming to devote more capacity to its 5G SA (standalone) network.

Only a tiny sliver of 4G/LTE will be left behind to maintain backwards compatibility.

This will negatively impact all 4G and early generation 5G hardware on T-Mobile's network.

The practical effect is that pre-X62/65 modems (e.g., X55) and 5G NSA and LTE-only gear will age poorly on T-Mobile if the aggressive LTE spectrum refarming proceeds according to the schedule in the leaked documents.

As always, it pays to have the latest cellular technology on T-Mobile's network.

How Soon Is LTE Going Away?

T-Mobile will be requiring all devices activated on its network to be 5G SA compatible starting as of January 1st, 2026.

Then over the next few years - 4G spectrum will be migrated to 5G, leaving only a single 5 MHz channel of 4G/LTE behind.

That is enough spectrum for very basic connectivity so 4G devices will still connect - but performance will be severely impacted.

T-Mobile is committed to keeping this small channel alive until 2035 - so consider this a ten year warning before 4G gear becomes completely obsolete and unusable on T-Mobile.

Concluding Thoughts

Some significant changes are coming to the cellular world - and there are some potentially exciting hardware upgrades to look forward to.

In particular, we will be watching closely to see how soon 5G modems that support SpaceX's newly purchased cellular spectrum come to market. Device manufacturers had ignored that spectrum when it was unused and owned by EchoStar, but SpaceX makes a much more compelling case for building in compatible radios.

Is there potential for Qualcomm to work support into next year's flagship X85 modem? Will Apple work it into next year's C2?

Or will this capability not emerge until 2027?

In the meantime, the writing is on the wall for 4G even sooner than we expected.

Customers with 4G gear should really be planning on upgrades in the next year or two, especially those on T-Mobile.

LTE devices will still be supported well through the start of the 6G era - but performance (and even coverage) will likely begin to decline, potentially dramatically.

With the rapid pace of change hitting 5G networks, we now consider anything with an X55 caliber modem (or older) to be obsolete and worth considering replacing.

Further Reading

5G Cellular Fundamentals for Mobile Internet - Our featured guide will help you understand what 5G is all about.

5G Cellular Fundamentals for Mobile Internet - Our featured guide will help you understand what 5G is all about.- Understanding Cellular Modem Specifications - Our in-depth guide to deciphering and understanding cellular modem specs

- Understanding Cellular Frequencies - Our guide will help you understand what different frequency bands are, and how the differences between them can be so critical.

- 5G Cellular Resources - All of our guides & articles tracking 5G.

And here is all of our recent 5G-related coverage:

Mobile Internet Resource Center (dba Two Steps Beyond LLC) is founded by Chris & Cherie of

Mobile Internet Resource Center (dba Two Steps Beyond LLC) is founded by Chris & Cherie of