Key Points:

- Amazon's Project Kuiper has been renamed Amazon Leo as Amazon prepares to take on Starlink starting in 2026.

- Facing mounting competition, legacy satellite internet provider HughesNet appears to be throwing in the towel, planning to refer new and existing customers to Starlink.

- SpaceX's Starlink continues to dominate satellite internet, but as competition looms, SpaceX has become surprisingly aggressive with price cuts and promotions.

- AST SpaceMobile is preparing to launch satellites with the "largest commercial communications array ever deployed" - aiming to bring satellite broadband to AT&T and Verizon customers next year.

- Legacy satellite providers are scrambling to find their place in a world dominated by fast moving giants.

A lot has changed since our last rundown of the satellite internet market back in May.

SpaceX has kept up an aggressive pace, launching more and more Starlink satellites, adding capacity, and aiming to build an insurmountable lead over potential competitors.

Meanwhile, Amazon is at last gearing up to take on Starlink head-on with Amazon Leo, the evolution of Project Kuiper.

And with these two titans set to clash, the rest of the satellite internet industry is scrambling for cover - trying to find their own niches to survive.

Things have never been more exciting - read on for the latest!

Table of Contents

Video Update

We broke the video version of this story into two parts:

Amazon’s Project Kuiper Rebranded as Amazon Leo

Of all the potential Starlink competitors in the pipeline, Amazon has always been the most credible.

After all, Amazon has near-infinite financial resources to tap into, extreme patience, and a globally recognized consumer brand and sales channel ready and waiting.

We have been tracking Amazon's Project Kuiper since 2019, when Amazon first announced plans to build a Starlink competitor.

Things started to get serious in April of this year when Amazon, at last, began launching Kuiper satellites into orbit.

Now Amazon is getting ready to start preparing Kuiper for a consumer launch - and the first step is giving it a proper name:

"Seven years ago, Amazon set out to design the most advanced satellite communications network ever built.

We started small, with a handful of engineers and a few designs on paper. Like most early Amazon projects, the program needed a code name, and the team began operating as “Project Kuiper”—inspired by the Kuiper Belt, a ring of asteroids in our outer solar system.

The code name stuck with us through many of our early milestones: filing and receiving initial licenses, signing the largest set of launch contracts in history, completing a successful prototype mission, and deploying our first full batch of production satellites earlier this year.

Now, we’re ready to share our permanent brand for the program: Amazon Leo, a simple nod to the low Earth orbit satellite constellation that powers our network."

To go along with the new name, Amazon has launched a web page for Amazon Leo with sub-pages for personal, business, and government customers, claiming that "a new era of internet is coming".

Other details remain sparse - including pricing and availability.

But interested potential customers can now sign up to be contacted when more details are available.

Amazon Leo Terminals Update

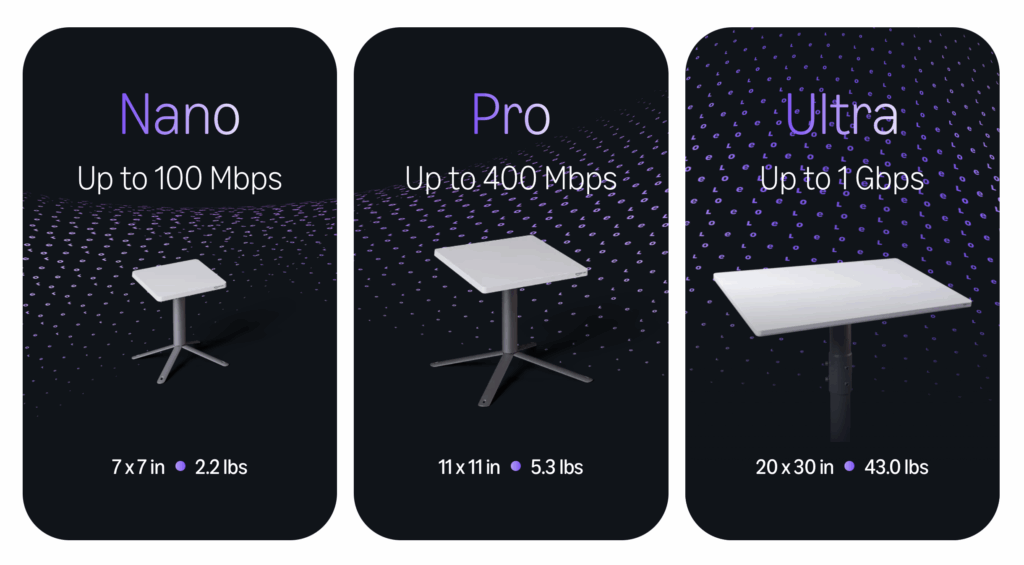

Amazon in 2023 previewed three terminals designed for Project Kuiper, and now that Leo has replaced the Kuiper name, Amazon has given the terminals official names as well:

- Leo Nano - An ultra-compact and "lower cost" design measuring 7" square and weighing just 2.2 pounds. This tiny design supports 100 Mbps speeds.

- Leo Pro - The standard Kuiper terminal is 11" square, 1" thick, weighs 5.3 pounds, and is capable of 400 Mbps. Amazon in 2023 claimed it could produce this terminal for "less than $400," though the actual retail price remains unknown.

- Leo Ultra - The professional / enterprise Kuiper receiver is 20" x 30" and weighs a hefty 43 pounds. It is capable of up to 1 Gbps performance.

In late November, Amazon bragged that the finalized Leo Ultra was now shipping to select enterprise customers for testing:

"Leo Ultra is the fastest customer terminal in production, with download speeds up to 1 Gbps and upload speeds up to 400 Mbps."

Amazon claims that Leo Ultra (but not the Nano or Pro) is even capable of full-duplex performance - delivering peak upload and download speeds simultaneously. That is indeed pretty phenomenal.

Amazon has not revealed any Leo terminal pricing yet.

Will Amazon look to match or beat Starlink terminal pricing, even if it has to subsidize the hardware costs?

Amazon Leo Timing and Constellation Update

The advantage of a low-earth-orbit satellite constellation like Amazon's Leo is that the satellites orbit vastly closer to the earth's surface - eliminating the speed of light latency delay that is unavoidable when communicating with traditional geostationary satellites in a fixed orbit 22,000 miles above the equator.

In contrast, Amazon Leo satellites orbit just 390 miles overhead.

But the catch with lower orbits is that the satellites are in constant motion through the sky - and a LEO constellation cannot offer 24/7 service until there are enough satellites in the constellation so that at least one is in view at any given time.

According to FCC filings, Amazon will be able to offer coverage across "most of North America" with 578 satellites deployed, out of the planned total of 3,232 satellites in the first-generation Kuiper constellation.

Amazon's updated Leo FAQ page reveals that some customers are already testing Leo:

"We began an enterprise preview in November 2025 to allow select business customers to begin testing the network using production hardware and software. We will roll out Amazon Leo service more widely in 2026 as we launch more satellites and add coverage and capacity to the network."

This initial service will likely be beta-level until gaps in satellite coverage are filled.

When will Amazon Leo be ready for consumers?

The most recent public statement on the Amazon Leo timeline was made by Amazon executive Ricky Freeman at a satellite industry conference in September.

He says that Amazon aims to have enough satellites for continuous coverage, allowing it to launch service in five countries (Canada, France, Germany, the UK, and the US) in Q1 2026.

From there, service will expand to 26 countries by the end of 2026, "global coverage" (likely over the oceans) and service in 54 countries in 2027, and in 2028, Amazon will serve 100 countries and will begin working on launching its second-generation constellation with 3,200 additional Amazon Leo satellites.

This is a VERY aggressive timeline. But when you are investing billions (and racing to catch SpaceX!), it pays to move as rapidly as possible.

The Amazon Leo Launch Campaign

To get Amazon Leo ready for customers, Amazon has pre-purchased almost every available rocket in the pipeline from almost every launch provider.

Amazon has the following rockets contracted to carry the Amazon Leo constellation to orbit over the next few years:

- ULA Atlas V - 27 satellites per launch. Three of eight launches have been completed. Next one set for December 15th.

- SpaceX Falcon 9 - 24 satellites per launch. Three launches completed, no further scheduled.

- ULA Vulcan Centaur - 45 satellites per launch. 38 launches are scheduled, with the first scheduled in early 2026.

- ESA Ariane 6 - 30+ satellites per launch. 18 launches are scheduled, starting in 2026.

- Blue Origin New Glenn - 49 satellites per launch. 27 launches contracted. Launches starting in 2026.

Though only 153 Amazon Leo satellites have launched so far as of early December 2025, there are a LOT of Leo launches in the pipeline to look forward to - showing how seriously Amazon is investing in this project.

Will New Glenn Change The Leo Launch Game?

SpaceX's Falcon 9 is the world's first affordably reusable rocket, and it has come to absolutely dominate the market for satellite launch services.

Basically, if you want to get a ride to space and you don't want to wait years (and pay more), the Falcon 9 is presently the only game in town.

And even Starlink competitors (including Amazon!) have been ponying up to hitch a ride on the Falcon.

The Falcon 9 has been one of the keys to Starlink's dominance - SpaceX's lower internal launch costs for Falcon 9 gives Starlink satellites a cheaper ride to space and a huge economic advantage over competitors.

But Amazon founder Jeff Bezos also owns a rocket company - Blue Origin. And Blue Origin's massive New Glenn rocket recently demonstrated its second successful launch and first successful landing on November 13th.

If Blue Origin can demonstrate not just a landing but rapid reuse, there will at last be a credible reusable launch alternative to SpaceX's Falcon 9.

New Glenn will be the key to Amazon rapidly expanding Amazon Leo.

If all goes well in 2026, Amazon will soon begin using New Glenn to rapidly expand the Amazon Leo constellation.

But even though New Glenn is larger and more capable than Falcon 9, Falcon 9 has been nailing landings for nearly a decade now (500+ landings, and counting!), and SpaceX has thoroughly optimized the Falcon 9 to be reliable and affordable.

New Glenn has a lot to prove beyond just a single landing.

But it is an exciting start.

And Blue Origin has an even bigger version of New Glenn on deck - the "New Glenn 9x4" builds on the basic design with more engines, pushing even heavier cargoes into orbit.

SpaceX & Starlink - Starship On Deck?

The space industry sometimes looks like a game of leapfrog...

The New Glenn is bigger and more capable than Falcon 9 - but SpaceX's under-development Starship is vastly larger still.

And while with New Glenn and Falcon 9, only the booster stage is reusable, Starship is designed to be fully reusable.

To put things into context - this is how much cargo to LEO (low earth orbit) various rockets can carry:

- SpaceX Starship - 100 - 150 tons (optimistic fully reusable design goal)

- Saturn V - 140 tons (the heaviest payloads ever launched - took us to the moon in 1969!)

- Blue Origin New Glenn 9x4 - 70 tons (first stage reusable)

- Falcon Heavy - 64 tons (fully expendable configuration), ~30 tons (all three booster cores recovered)

- Blue Origin New Glenn 7x2 - 45 tons (first stage reusable)

- Space Shuttle - 27 tons (reusable)

- ULA Vulcan Centaur - 27 tons

- SpaceX Falcon 9 - 23 tons (expendable), 18.5 tons (first stage reusable)

- ULA Atlas V - 19 tons

Ever more capable satellite internet constellations depend on getting a lot of mass into orbit as quickly and cheaply as possible.

If SpaceX can get Starship to meet its fully reusable design goals, it will be able to carry more cargo into orbit at a vastly lower cost than ever before.

As we have covered here extensively, SpaceX is betting the future of Starlink on Starship's capabilities.

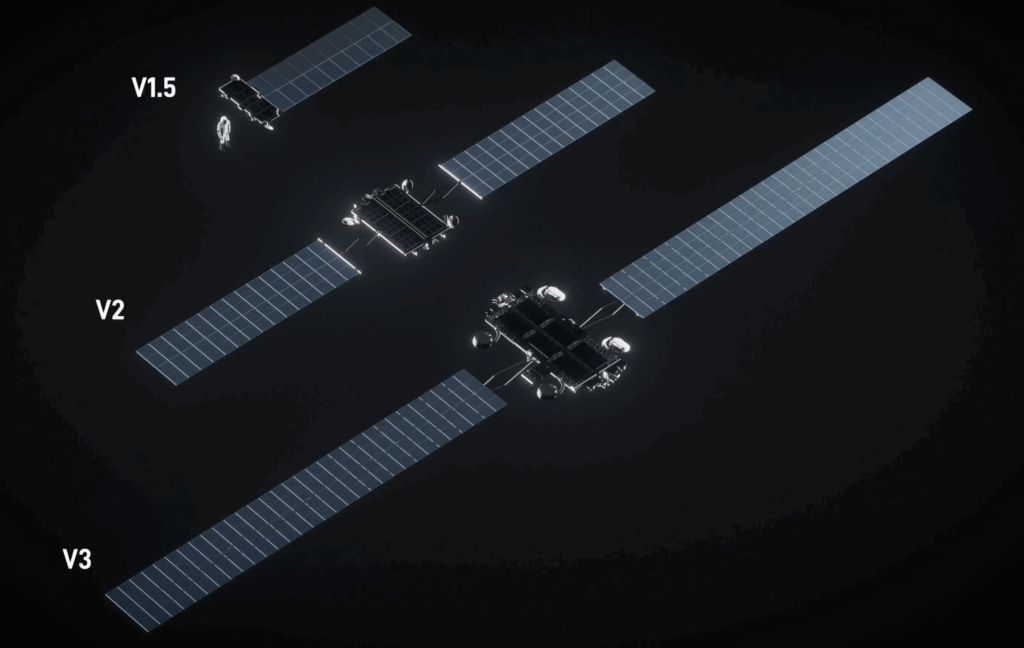

The next generation of Starlink satellites is too big to hitch a ride on the Falcon, so hopefully, in 2026, SpaceX will be ready to start carrying Starlink V3 satellites into orbit.

The Starlink V3 satellites will each have 10x the downlink and 24x the uplink capacity of the V2 Mini Starlink satellites.

For more analysis on what Starlink V3 satellites will be capable of, see our story from earlier this year.

At first, expect SpaceX to treat the Starship upper stage as expendable - it can carry Starlink satellites to orbit even if the Starship orbital stage is not (yet) able to survive landing intact enough for reuse.

But once Starship reuse is figured out, the economics of space will once again be seismically shifted.

After a string of disappointing failures in early 2025, SpaceX's most recent Starship test flights in August and October were completely successful - paving the way for the next generation of Starship and Starlink V3 satellites to begin testing in early 2026.

Starlink's Next Generation - And Starlink Mobile Cellular Service

In addition to serving as the foundation for the next generation of the Starlink network, the Starlink V3 satellites will host SpaceX's next-generation direct-to-cellular service.

As we have covered here before, SpaceX has been piggybacking cellular payloads on a subset of Starlink satellites for a while now to enable "Direct To Cell" capabilities that allow communications between Starlink satellites and regular unmodified cellular phones.

Up until now, these capabilities have only existed in partnership with terrestrial carriers - SpaceX has to work with legacy partners because it has no cellular spectrum rights of its own.

In the USA, SpaceX partnered with T-Mobile for the T-Satellite service that launched in July.

But SpaceX's complete reliance on partners is changing.

By acquiring spectrum from EchoStar, SpaceX is effectively turning itself into a new nationwide (and potentially global) cellular provider.

But don't get too excited just yet.

Unlike the first-generation direct to cell service, the new spectrum SpaceX is buying is NOT compatible with current cellular devices or the current satellites in Starlink's Direct to Cellular constellation.

As we covered in our featured story - EchoStar, the owner of Dish Network and Boost Mobile, has given up the dream of building a new fourth nationwide cellular carrier and is selling off its core spectrum assets to AT&T and SpaceX.

Up until now, SpaceX relied on terrestrial partners to essentially borrow spectrum rights for limited direct-to-cellular service.

But now, once this deal closes, SpaceX will have some cellular-appropriate spectrum that it actually wholly owns global rights to.

SpaceX President & COO Gwynne Shotwell hinted at the potential:

"SpaceX's first generation Starlink satellites with Direct to Cell capabilities have already connected millions of people when they needed it most – during natural disasters so they could contact emergency responders and loved ones – or when they would have previously been off the grid. In this next chapter, with exclusive spectrum, SpaceX will develop next generation Starlink Direct to Cell satellites, which will have a step change in performance and enable us to enhance coverage for customers wherever they are in the world."

SpaceX buying cellular spectrum rights is a major strategic shift - potentially opening up the possibility that SpaceX might someday directly offer Starlink Cellular service.

Adding fuel to the rumor fire, SpaceX has even recently filed for a "Starlink Mobile" trademark covering "cellular personal communication services" among other things.

For more on these seismic shifts at the intersection of satellite and cellular, see our featured update and this video:

Starlink Lowering Prices as Competition Looms

It is costly to build a satellite constellation, but once it is built, there is little incremental cost for adding new customers - especially in uncongested areas where the satellites passing overhead would otherwise be sitting idle.

With 7,000+ active Starlink satellites in orbit, SpaceX has plenty of capacity to start playing pricing games, setting new baselines that will make it extremely painful for future competitors like Amazon to carve out a niche in the market.

Starlink has slashed terminal costs - reaching a new low on Black Friday by dropping the Starlink Mini to just $229, and the Starlink Standard to $279. (The sale prices remain active as of this posting...)

And SpaceX has debuted a new speed-tiered residential plan starting as low as $40/mo for 100 Mbps service.

Clearly, SpaceX is prepared to be aggressive with pricing moves.

It will be interesting to see how and if Amazon attempts to undercut these latest Starlink offerings.

For more on Starlink - including the hardware and plans we recommend, check out our free and regularly updated guide focused on all things Starlink:

Starlink Satellite Internet for Mobile RV and Boat Use

Learn More:

Starlink's Referral FAQ.

Use our referral link when purchasing equipment from Starlink.com and activating a consumer Residential or Roam Unlimited data plan - and get a FREE month of service!

And so will someone on our team, which helps us keep our multiple lines of service active for continued testing.

It's a win-win - you save money and help support MIRC!

Direct To Cell Update: AST SpaceMobile Building Out, Lynk Merging

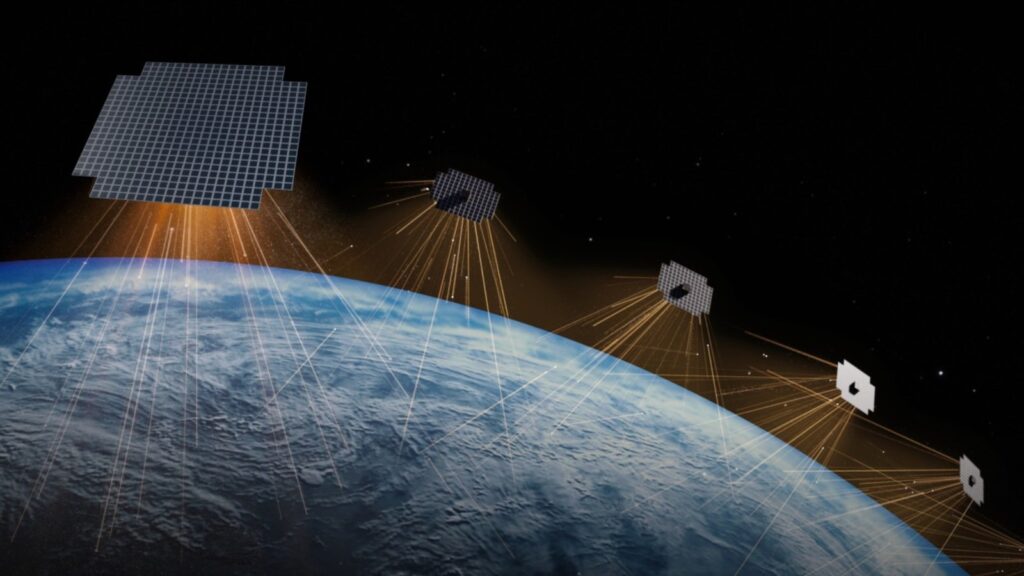

While T-Mobile has partnered with Starlink for direct-to-cellular service, AT&T and Verizon have invested in competitor AST SpaceMobile.

SpaceMobile claims to be on track to launch the first of its gigantic next-generation BlueBird satellites on December 19th, and the second in January.

From there, an ongoing launch campaign will target launching a total of 45 to 60 satellites by the end of 2026, enough satellites to enable continuous service in North America.

What makes SpaceMobile unique is just how large its satellite antennas are - the "largest commercial communications array ever deployed".

SpaceMobile claims these gigantic super-sensitive antennas will enable satellite coverage even indoors.

AST SpaceMobile will need around 25 satellites to begin powering beta service - likely not possible until mid-2026, assuming all goes well.

Lynk Merges, Looks Increasingly Niche

The other notable player in the Direct to Cell space is Lynk - which has launched a limited satellite texting service in a few minor countries, but has not made any moves towards the American market yet.

Lynk has announced it is merging with satellite spectrum holding company Omnispace to gain access to additional spectrum. It is also cutting a deal with the legacy satellite provider SES to be a "major shareholder" with global ground infrastructure to help Lynk roll out further.

Even with these deals, it is unlikely that Lynk will amount to much of a player in the upcoming battle of the giants.

But with the backing of SES, Lynk does still remain worth watching, however.

T-Mobile Offers Satellite 911 To (Almost) Everyone

While Verizon and AT&T are hoping to eventually fill their coverage gaps with satellite service from SpaceMobile, T-Mobile is taking advantage of its lead with its Starlink Direct to Cell powered service, and it is even now offering 911 texting coverage to ALL customers on all carriers, for free.

“T-Mobile Text to 911 with T-Satellite gives peace of mind. It’s there when you need it the most. And it’s too important to keep gated. Now all wireless users with a compatible phone can sign up for T-Mobile Text to 911 for absolutely free.”

The catch: You need an unlocked phone, and you need to sign up and install a T-Mobile eSIM before you find yourself stuck in the middle of nowhere in an emergency situation.

T-Mobile is hoping that customers who try the free emergency satellite service might eventually decide they want the paid service for additional capabilities beyond just emergencies.

For more information on signing up - see T-Mobile's press release.

Note: Because recent Apple and Google phones already have their own built in native satellite 911 texting service, many iPhone and Pixel phone owners are not able to sign up for T-Mobile's free emergency coverage. But if your phone is eligible - this free service s is worth pursuing. Better safe than sorry!

Apple's Partner GlobalStar - Up For Sale?

Apple's satellite partner, GlobalStar, has been filing licenses with the FCC, indicating it is already underway upgrading its ground stations to support its upcoming next-generation satellite constellation, but just what the new satellites will be capable of remains unclear.

Apple is notoriously secretive.

In the meantime, rumors have been swirling that GlobalStar may be putting itself up for sale. Some analysts speculate that rival SpaceX might try to acquire GlobalStar, securing Apple's business.

As we discussed in our recent featured story, SpaceX has been putting tremendous pressure on Apple to abandon its own satellite plans and embrace Starlink.

If Apple decides to go this route, it would be a significant shift in strategy.

HughesNet Calling It Quits?

Back in the day, HughesNet dominated the consumer satellite internet market.

But high latencies, data limits, congestion, and frustrating customer service won HughesNet few actual fans.

People typically used HughesNet because they had few other choices, and since Starlink came along, HughesNet has been hemorrhaging customers.

And now with Amazon Leo looming, it appears that HughesNet is acknowledging that old-school geostationary satellites have lost the war for consumer satellite internet.

And with Hughes' parent company, EchoStar, selling its key cellular spectrum to SpaceX, it appears that a deal has been cut to begin winding down HughesNet as well.

A Hughes financial filing released in November discloses:

"The SpaceX License Purchase Agreement also provides for future long-term commercial agreements that will enable EchoStar to offer their Wireless subscribers access to SpaceX’s next-generation Starlink Direct to Cell text and voice and broadband services utilizing certain rights and licenses related to the Spectrum that are to be conveyed by EchoStar to SpaceX at the Spectrum Acquisition Closing. The commercial agreements will also provide for a fee-based referral program that lets us refer existing HughesNet customers and new Starlink customers to SpaceX."

In other words, Hughes will be getting paid a bounty for sending its customers to Starlink.

Going forward, it appears likely that Hughes will wind down its consumer satellite internet operations and focus instead on enterprise customers.

EchoStar CEO Hamid Akhavan said as much during an investor presentation in September:

“We saw a Starlink come in, we saw [Amazon’s Project] Kuiper potentially come in, and others. We kind of saw that and decided that we would reduce our emphasis. We decided that we need to expand our approach to [the] enterprise. ... You will consider us primarily an enterprise company...and we’ll serve consumers greatly as long as it comes."

In other words, HughesNet's days are clearly numbered.

ViaSat - Back Again

While Hughes may be calling it quits, the other major legacy consumer geostationary satellite broadband provider, ViaSat, is trying to get back in the hunt.

We have tracked the three satellite geostationary ViaSat-3 constellations since it was first announced in 2015, with a planned launch in 2019.

If ViaSat-3 had launched on time, it would have been revolutionary.

When ViaSat-3 was initially proposed, each of the three individual planned ViaSat-3 satellites was designed to have more raw data capacity than ALL other commercial satellites currently in orbit - combined!

After years of delays, the first ViaSat-3 was finally launched in April 2023.

And then tragedy struck when the satellite's gigantic antenna failed to fully unfold upon reaching its target orbit.

ViaSat spent the past two years regrouping from this failure - working to ensure the subsequent two ViaSat-3 launches do not suffer the same fate.

The first of these two satellites launched on November 13th, and it is currently en route to its final geostationary orbit, where it will hopefully avoid the malfunction that derailed its predecessor.

"ViaSat-3 F2 is anticipated to double the overall bandwidth capacity of Viasat’s entire existing fleet. The successful launch of the satellite marks a significant step forward for Viasat’s global, multi-orbit network roadmap, helping Viasat further provide unrivaled flexibility to move and concentrate capacity wherever it’s most needed—on land, at sea, or in the air."

If all goes well, this new satellite should be ready for commercial service in early 2026.

But having lost significant consumer momentum, it seems likely that ViaSat will focus on aviation, enterprise, government, and high-end maritime customers going forward.

To that end, ViaSat subsidiary InmarSat Maritime has been showing off a new VS60 maritime terminal and NexusWave service that bonds together GEO, LEO, and cellular data streams:

"NexusWave is Inmarsat’s fully managed, bonded multi-network service combining capacity from GEO Ka-band, LEO, LTE, and L-band networks in a single intelligent connectivity solution. With the introduction of the ultra-high-capacity, high-speed ViaSat-3 satellites, customers will enjoy faster data transfers and improved network efficiency to support digitalisation and crew welfare at scale for a truly ‘office-like’ and ‘home-like’ onboard internet experience."

Pretty nice - but not likely relevant to most of the mainstream nomadic audience.

In addition to its ongoing geostationary satellite efforts, ViaSat also has some interesting future ambitions for direct-to-device services.

Last January, the European Space Agency announced that it had contracted with ViaSat to "explore a partnership concerning a direct-to-device (D2D) satellite system, aiming to provide mobile broadband connectivity anytime, anywhere."

With Starlink fully operational and Amazon Leo actively under deployment, it seems a little late to start "exploring" - but we will be keeping an eye out to see if anything emerges from these initiatives.

Concluding Thoughts

The legacy satellite industry has been completely overwhelmed by the sheer scale of SpaceX's 8,500+ satellite Starlink constellation.

Thanks to SpaceX's launch dominance - Starlink satellites now actually far outnumber all other satellites in space!

SpaceX Starlink satellites are designed for a five year lifespan, and the first waves are already being replaced by more capable new generations of hardware. This continuous upgrade cycle looks likely to just keep ramping up, with SpaceX proven capable of multiple Starlink launches per week.

And when Starship comes online, this dominance could increase.

But perhaps Amazon's deep pockets can pull together a viable competitor - and it looks like we will only have a few more months of waiting before we see whether Amazon's Leo launches with a roar or a whimper.

In the meantime, legacy satellite providers are hunkering down to find niches to survive.

And it is indeed a fight for survival and relevance. Most satellite companies (like OneWeb and Iridium) that had previously had broader consumer ambitions are focusing exclusively on enterprise and government markets going forward.

Manik Vinnakota, the VP of Products and Customer Solutions for Canadian geostationary satellite company Telesat explained to Fierce Networks how the world is changing:

"We saw the writing a bit early. GEO is not going to continue forever, so let's cannibalize ourselves by doing what customers need, rather than us being cut out of the market by someone with LEO. There will be four or five large LEO networks in the world, and that is a big enough market for four or five players to make decent returns."

Telesat is building its own LEO Lightspeed network to serve enterprise customers, launching service in 2027.

But will even enterprise-focused satellite operators be able to keep relevant in a world dominated by SpaceX and Amazon?

What will the world look like in 2027?

Things are changing fast - and there are certainly interesting times ahead!

Further Reading

- Starlink Satellite Internet For Mobile RV And Boat Use - Our featured guide focused on taking advantage of SpaceX's Starlink on the go.

- Mobile Satellite Internet Options -

Our featured guide on all the current and future satellite internet options of interest to RVers and cruisers.

Our featured guide on all the current and future satellite internet options of interest to RVers and cruisers. - All our Satellite Internet Resources - Our collection of guides, gear center entries, and news coverage on satellite internet.

And here is all of our recent satellite internet coverage:

Mobile Internet Resource Center (dba Two Steps Beyond LLC) is founded by Chris & Cherie of

Mobile Internet Resource Center (dba Two Steps Beyond LLC) is founded by Chris & Cherie of